A better picture of Obama’s, and the Democrats’, economic plans is emerging. First, he is announcing plans to raise taxes in a recession.

Obama plans to unveil his goals for scaling back record deficits and rebuilding the nation’s costly and inefficient health care system Monday, when he addresses more than 100 lawmakers and budget experts at a White House summit on restoring “fiscal responsibility” to Washington.

In his weekly radio and Internet address today, Obama expressed determination to “get exploding deficits under control” and described his budget request as “sober in its assessments, honest in its accounting, and lays out in detail my strategy for investing in what we need, cutting what we don’t, and restoring fiscal discipline.”

Reducing the deficit, he said, is critical to the nation’s future: “We can’t generate sustained growth without getting our deficits under control.”

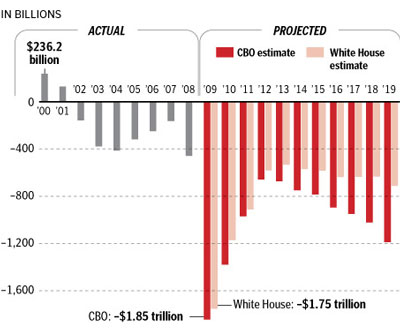

How is he going to get the deficits under control, considering that he just signed a bill that adds over a trillion dollars to them?

Obama proposes to dramatically reduce those numbers by the end of his first term, cutting the deficit he inherited in half, said administration officials, speaking on condition of anonymity because the budget has yet to be released. His budget plan would keep the deficit hovering near $1 trillion in 2010 and 2011, but shows it dropping to $533 billion in 2013 — still high in dollar terms, but a more manageable 3 percent of the overall economy.

To get there, Obama proposes to cut spending and raise taxes. The savings would come primarily from “winding down the war” in Iraq, a senior administration official said. The budget assumes that the nation will continue to spend money on “overseas military contingency operations” throughout Obama’s presidency, the official said, but that number is significantly lower than the nearly $190 billion the nation budgeted for Iraq and Afghanistan last year.

Obama also seeks to increase tax collections, primarily by making good on his promise to eliminate the temporary tax cuts enacted in 2001 and 2003 for wealthy taxpayers, whom Obama defined during the campaign as those earning more than $250,000 a year. Those tax breaks would be permitted to expire on schedule for the 2011 tax year, when the top tax rate would rise from 35 percent to more than 39 percent.

OK so we raise tax rates in a recession and that increases revenue ? Democrats seem to think that people will not alter behavior when incentives change.

Even some non-partisan observers question the wisdom of announcing a plan to raise taxes in the midst of a recession. But senior White House adviser David Axelrod said in an interview that the tax proposals reflect the ideas that won the election last fall.

“This is consistent with what the president talked about throughout the campaign,” and “restores some balance to the tax code in a way that protects the middle class,” Axelrod said. “Most Americans will come out very well here.”

How high could those rates go ? Here’s what a Democrat Congressman told his constitutents last week.

Congressman Jerry McNerney (D-Pleasanton) hosted “Congress at your Corner” from 9:30 to 10:30 this morning. The meetings are “part of McNerney’s effort to reach out to and hear from citizens in the 11th District.” I have never gone to anything like this before, but decided to go to express my displeasure about the stimulus package. Keep in mind that this is NORTHERN CALIFORNIA. The meeting was held in a local bagel cafe, and I was happy to see that the place was packed with probably about 50-75 people. The vast majority of them were extremely angry about the stimulus package. It started out with him taking questions from the crowd, but then they started a line for people to talk to him privately because things were getting “out of control”. Several people then asked if he would consider having a town hall style meeting with microphones, etc. We’ll see if that happens. I’m not betting on it.

The writer finally got to talk to the Congressman.

When I got my time with him, I explained to him that even people who make $150k in Northern Cal. are not “rich” and should not be taxed as if they were. (A 1400 sq ft, 40 year old home here goes for over half a million, even after the housing slump. Then you add in real estate taxes, state income taxes, 10% sales tax, gas prices, utility costs, etc.) I also expressed my concern that about half the people in the country now pay no income taxes, so there is overwhelming incentive for them to keep voting for democrats and therefore higher taxes for the rest of us. He told me that he thought tax rates should go up for the very rich and that the top marginal tax rate should be 90%. I couldn’t believe what I was hearing, so I asked in a voice that many in the room could hear if he really meant 90%, and he said yes. Several people asked me after my turn was over if they heard correctly what he said, and were amazed when I said yes.

Here is a Congressman who thinks that the rich will sit still and let the government take 90% of their income with taxes. How did that work out for Herbert Hoover ?

There actually is some history of revenue changes with tax rate changes. I doubt that Congressman has read any of this, any more than he read the “stimulus bill” he voted for. In fact, Obama told Charlie Gibson, in the most revealing answer of the primary debates, that he would raise capital gains tax rates even if it lost money !

Welcome to Obamanomics.