UPDATE #2: The Chinese have noticed what the Fed is doing and are not happy about it. That is very bad news for the dollar.

UPDATE: There is also weirdness going on in the real estate market. Look at this piece on foreclosures and what is happening. Now the stock market began a swoon. Maybe this is the end of the bear market rally.

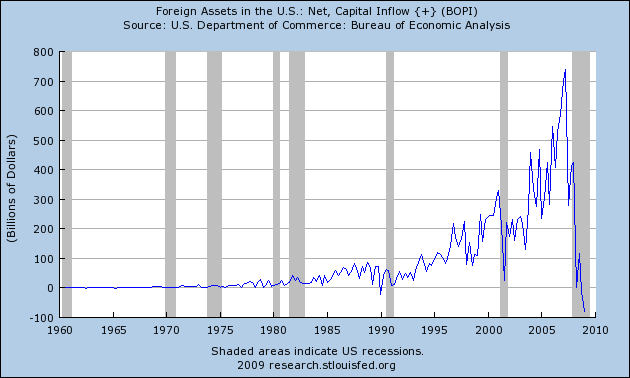

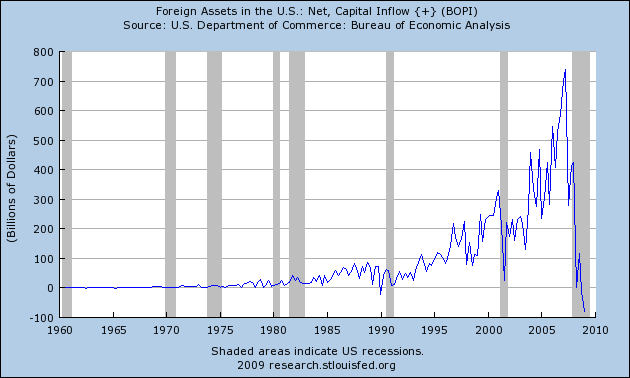

Several months ago I posted a chart of federal money creation. Where has this money been going ? This may explain it. Some went into the housing bubble, but much is going out of the country. Look at this:

Since 1995, capital has flowed into the US from other countries. Then came 2008.

Comparing this data with TIC releases, indicates that from January to May the total capital outflows from the U.S. amount to ($314) billion in assets, consisting of central bank purchases of $50 billion, however, matched with private investor dispositions of $364 billion.

Ignoring the implications of what this decline would mean for an economy that relies exclusively on credit growth in order to perpetuate the monetary Ponzi scheme that the US economy has been for years, the simple conclusion here is that a combination of declining consumer credit and foreign interest for US debt purchases has very negative implications for the credit bubble the Federal Reserve is trying to reflate. As for the consequences for the U.S. Dollar as a result of this activity, these have recently become all too clear.

The Treasury seems to be swapping bonds that are being repatriated and replacing them with Treasuries. This may make the foreign bond holders whole but what happens to us ?

It would appear that foreign central banks have been swapping agency bonds for Treasury bonds, but that’s not how the markets work. First, they would have to sell those bonds, before they could use the proceeds to buy government debt. So to whom did they sell those Agency bonds in order to afford the Treasury bonds?

They sold them to the Treasury. If you do that on your tax return, it is called a “sham transaction.”

These are the three critical points to remember as you read further:

1. The US government has record amounts of Treasuries to sell.

2. Foreign central banks, which have a big pile of agency bonds in their custody account, would like to help but want to keep things somewhat under the radar to avoid scaring the debt markets.

3. The Federal Reserve does not want to be seen directly buying US government debt at auctions (and in fact is not permitted to, but many rules have been ‘bent’ worse during this crisis), because that could upset the whole illusion that there is unlimited demand for US government paper, but it also desperately wants to avoid a failed auction.

For various reasons, the Federal Reserve cannot just up and start buying all the Treasury paper that becomes available in record amounts, week after week, month after month.

Instead, it uses this three-step shell game to hide what it is doing under a layer of complexity:

Shell #1: Foreign central banks sell agency debt out of the custody account.

Shell #2: The Federal Reserve buys those agency bonds with money created out of thin air.

Shell #3: Foreign central banks use that very same money to buy Treasuries at the next government auction.

What is the purpose of this shell game ?

The Federal Reserve has effectively been monetizing far more US government debt than has openly been revealed, by cleverly enabling foreign central banks to swap their agency debt for Treasury debt. This is not a sign of strength and reveals a pattern of trading temporary relief for future difficulties.

This is very nearly the same path that Zimbabwe took, resulting in the complete abandonment of the Zimbabwe dollar as a unit of currency. The difference is in the complexity of the game being played, not the substance of the actions themselves.

The shell game that the Fed is currently playing does not change the basic equation: Money is being printed out of thin air so that it can be used to buy US government debt.

When the full scope of this program is more widely recognized, ever more pressure will fall upon the dollar, as more and more private investors shun the dollar and all dollar-denominated instruments as stores of value and wealth. This will further burden the efforts of the various central banks around the world as they endeavor to meet the vast borrowing desires of the US government.

This will not end well. I also still think the stock market rally is a bear market rally. Here is the full article.

Zimbabwe !