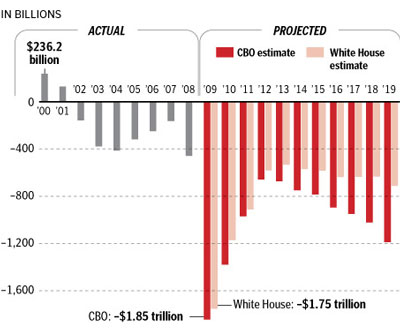

I see a lot of discussion about what the “Tea Party” activists are concerned about. It isn’t really taxes. As others, including David Frum, have pointed out, taxes are not the issue right now. The rates are still fairly low by historical standards. This is what we are concerned about:

There are lots of complaints about Bush’s spending and I was unhappy with it. Still, the graph shows the difference. We have never seen anything like this before in our history. There is no way this debt can be repaid without either huge tax hikes or runaway inflation. We were already worried about paying for the Boomer generation retirement benefits in Social Security and Medicare. This will make that impossible. Obama said he wanted to change the country. That is certain unless he is stopped. That is what the tea parties are about.

I believe we will see both huge tax hikes and hyperinflation. It’s baked in as it appears the Fed has now been cornered into debt monetization. While some of the econ goons are whooping with delight over the trade balance swoon, what that promises is that foreign central banks going forward will have fewer and fewer US$ trade surpluses from which to buy US Treasury debt. And that’s on top of their disgust with the current political budget machinations which devalue the dollar. Consequently, the only option is for the Fed to print more and more money out of thin air to buy Treasury debt that is becoming monsterously viral. Two things result from all this…dollars dive and more taxes are needed to make up the spread. Since most of us haven’t the where with all to flee to a tax haven, we are essentially defacto prisoners here for the time being, and the only way to fight back is to utilize what few avenues remain to convert dollars into assets that can’t be easily confiscated or abused. Assets that hold their ‘real’ value through deflationary or inflationary storms.

Mark Steyn’s latest column points out that all this deficit spending assumes that future generations will have the ability to pay it all off. But the demographics are against it. Current wealthy nations are not making enough youngsters. The nations providing the bodies don’t appear to have the overall human capital to cover the obligations. I don’t see it ending well.

The one tiny bit of good news is that housing prices may come back. Since I have two, that would be welcome. This all began in the 70s when people were fleeing depreciating dollars. That’s when housing began to be a hedge. The trade situation is seriously impacting Asia right now. The riots in Thailand are directly connected.

This from Stratfor.com

The situation in Thailand is part of a much larger issue. Despite a few silver linings here and there, the economic crisis remains a very dark cloud hanging over every region. East Asia in particular is suffering because most countries there have underdeveloped domestic demand and a disproportionate reliance on exports for growth. With the world’s rich consumption centers cutting spending at every turn, the pounding of Asian manufacturers is continuing. In response, they are slashing wages and hours and laying off workers.

This is a serious problem for a part of the world with an overflowing population, where social stability is temporary at best, and where waves of unemployment have a history of cresting into full-scale upheaval and revolution.

Against that backdrop, the government’s claims on Tuesday that Bangkok was returning to normalcy appeared especially flimsy. The political opposition movement that launched the rallies, the so-called Red Shirts, emerges from the mostly rural northern and northeastern provinces, where the bulk of the Thai population dwells. Their gripe with the current ruling party is that it is dominated by urbanites and not as generous as its predecessors in doling out subsidies and development aid to the countryside. While the military and police have cleaned up Bangkok for the time being, the economy deterioration has been worse than expected, as Thailand’s finance minister announced Tuesday. The ranks of the rural opposition easily could swell and break upon Bangkok again.

Elsewhere in the region, harsh economic adjustments are under way and governments are worried about maintaining their grip. In both Malaysia and Japan, the power of parties that have dominated the political system since the 1950s is eroding — fast. Malaysia’s ruling party has been repeatedly frustrated in state and local elections over the past year by a rising opposition movement. The government’s attempts to put on a fresh face with new leadership, to crack down on corruption, to stimulate the economy and to eradicate old ethnic rivalries have failed to convince voters. The result is a fracturing government, a more ambitious opposition and more instability.

In Japan, the situation is outwardly calmer — social unrest is not commonly observed in this staid society — but the ramifications are more consequential. Japan’s economy is the second biggest in the world, and it is suffering perhaps the worst from the drop in exports — the last vector for growth in a country where domestic demand is stagnant. Bankruptcies are on the rise throughout Japan’s manufacturing sector, and the numbers of part-time workers are growing. Meanwhile, prices are sinking so fast that a return to deflation — the scourge of the 1990s and early 2000s – seems inevitable. The banking system and public finances are overburdened with debts. What’s more, Prime Minister Taro Aso must call elections by October. If the incumbent party is thrown out this year, it would not be significant in and of itself – but it would reflect the underlying social changes that are pushing Japan closer to a breaking point. And in Japanese history, breaking points come like earthquakes.

Michael Kennedy “The one tiny bit of good news is that housing prices may come back.”

You sound like someone that stands to gain financially if housing prices increase. You really want another housing bubble? Another mortgage meltdown? Another financial crisis? The reason we had the subprime crisis was because median home prices were higher than 2.5 to 3 times median income, which is simply unsustainable. Housing prices still need to fall another 20% to 30% before equilibrium is reached. The housing bubble has burst, and must fall to pre-bubble levels before the imbalance is purged out of the system. The math never lies, and you can’t violate the law of gravity.

I don’t disagree, toyota guy but I wouldn’t mind getting my money out of my house. I was planning to sell it next year and move to Arizona where I also have a house. Once that move is complete, the collapse can resume. Seriously, my house value is probably fairly stable but I wouldn’t mind a bump for a year or so of another $100 k or two. I think, in fact, what will happen is a frantic effort to reinflate the bubble. That is basically what got us here as Greenspan (maybe the onset of senility) decided to reflate the dot-com bubble and that gave us the housing bubble. I tend to follow the Austrian School and that fits their theories. If they are going to be foolish, and I think they are, I am not adverse to a small profit.

Your graph is really just meaningless, isn’t it? Just a mix of random bars and numbers… Who produced it? What exactly is it a graph of? What spending is included in the Obama years that was redacted from the Bush years? The graph doesn’t “really show the difference”

It is a graph of deficits, Bill. Isn’t that obvious ? You’re trying but you’re not doing much to shield Obama from scrutiny. Did you notice the difference between Obama’s estimate and the CBOs ? I think they call that lying in some circles.