The debt limit talks seem to go on forever. Obama and the Democrats seem oblivious to the danger. All they think of is re-election. All is politics. Our present day ruling class seems even worse than those who saw the Civil War come and the Panic of 1893 and 1903. The last presidential administrations that seemed to understand economics were those of Harding and Coolidge and Eisenhower. Both preceded the “Great Society” of Lyndon Johnson that began the race to the bottom.

What we have had since Reagan is a Congress, and often a president, who ignored all rules of economics and saw government spending as the key to re-election. We are about to pay the price.

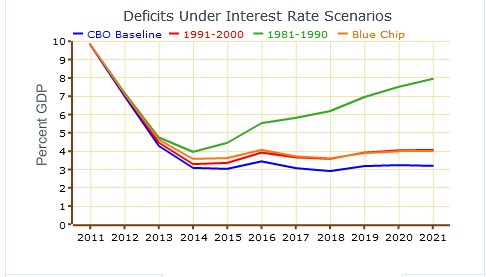

Here is an analysis of the effect of interest rates on our debt.

We have seen very low interest rates as a result of the fact that the Federal Reserve has been buying Treasury debt. What would happen if that debt had to be sold to others at a price determined by a market in interest rates ? Note the 1981-1990 scenario. It adds $5 trillion in debt by 2021, only ten years from now.

Instead, let’s look at an “alternative scenario” with the books uncooked by CBO.

You could look at the pdf file. Or you could look at some simple projections.

CBO estimated that 1 percent higher interest rates each year could increase deficits by $1.3 trillion over ten years. CBO also estimated a few other “rules of thumb” to show how changes in inflation and economic growth have significant impacts on budget forecasts. The projections show that lower economic growth of just 0.1 percentage point each year could increase deficits by $310 billion over ten years, while 1 percentage point higher inflation each year could add almost $900 billion to deficits.

The alternate scenario chart shows the debt going to 250% of GDP, about where Japan is now. Japan has had a “lost decade” that has lasted 20 years.

We will have a Greece style collapse before then, probably led by public employee unions.