Here is the latest post on Political Animal, a leftist blog sponsored by Washington Monthly, a leftist magazine.

Political Animal

Blog

August 06, 2011 11:05 AM

A timeline of events

By Steve Benen

Let’s take a stroll down memory lane, shall we?

1980: Ronald Reagan runs for president, promising a balanced budget

1981 – 1989: With support from congressional Republicans, Reagan runs enormous deficits, adds $2 trillion to the debt.

Reagan did not have a Republican Congress during his two terms. He did have a Republican Senate for his first six years. Bob Dole was Majority Leader, which was no help in cutting spending.

Lie #1

1993: Bill Clinton passes economic plan that lowers deficit, gets zero votes from congressional Republicans.

Bill Clinton passed a tax increase which Republican predicted would slow economic growth. Bush had also raised taxes at the insistence of Democrats and a recession cost him re-election.

1998: U.S. deficit disappears for the first time in three decades. Debt clock is unplugged.

The fact is that Republicans took over both houses of Congress in 1995, the House for the first time since the post-war era. The stock market took off and revenues poured in from a good economy and the internet bubble which burst in 2000.

2000: George W. Bush runs for president, promising to maintain a balanced budget.

2001: CBO shows the United States is on track to pay off the entirety of its national debt within a decade.

In fact, the national debt kept climbing and the “surplus” was on paper only. Bush inherited the recession that followed the bursting of the internet bubble in 2000.

2001 – 2009: With support from congressional Republicans, Bush runs enormous deficits, adds nearly $5 trillion to the debt.

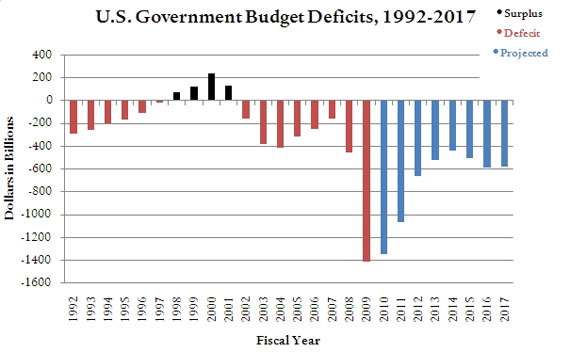

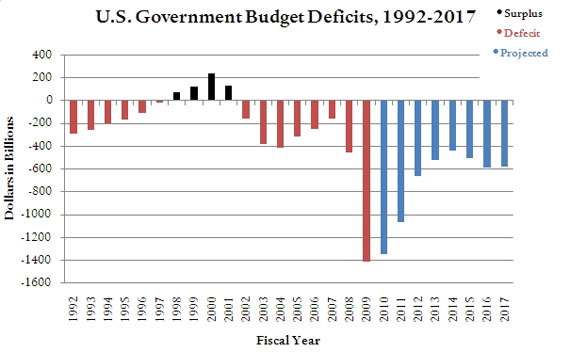

The Bush deficits were declining the last two years of his term and the Democrats took over Congress in 2007. The Bush deficit in his last year was 10% of the present deficit. Notice Steve Benin doesn’t provide numbers.

That shows the deficits Obama inherited. Notice the increase after the Democrats took Congress in 2007.

2002: Dick Cheney declares, “Deficits don’t matter.” Congressional Republicans agree, approving tax cuts, two wars, and Medicare expansion without even trying to pay for them.

This is a matter of policy choices. I am no fan of Bush in the spending department. He should have vetoed some spending bills that Hastert told him to sign. It was no fluke that Hastert’s district, after he retired from Congress, was won by a DEmocrat.

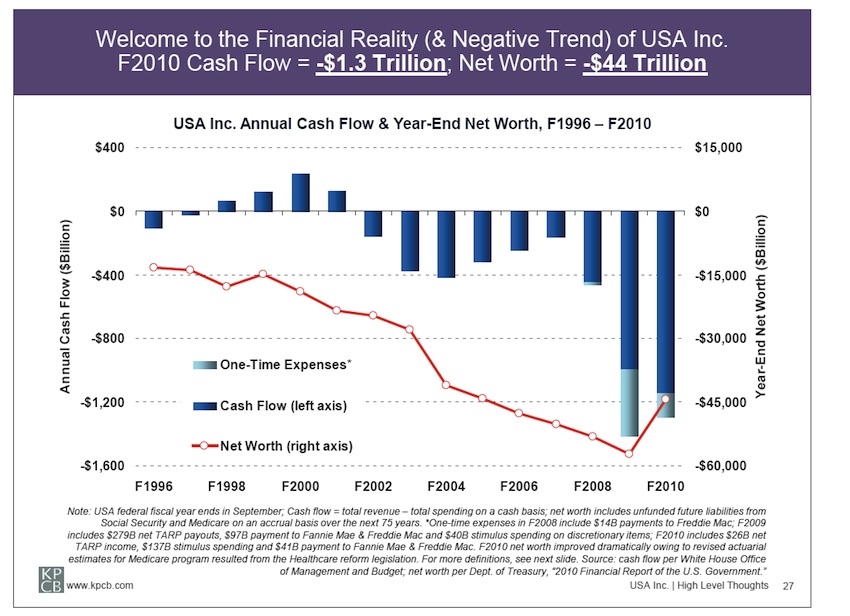

2009: Barack Obama inherits $1.3 trillion deficit from Bush; Republicans immediately condemn Obama’s fiscal irresponsibility.

The condemnation was of his plans to spend wildly.

2009: Congressional Democrats unveil several domestic policy initiatives — including health care reform, cap and trade, DREAM Act — which would lower the deficit. GOP opposes all of them, while continuing to push for deficit reduction.

No one with any economic knowledge would believe that Obamacare and Cap and Trade would lower the deficit. The most serious effect Obama has had thus far is the avalanche of regulation that has descended on business making anyone with money unwilling to invest. That is where jobs come from and the economy is stalled.

September 2010: In Obama’s first fiscal year, the deficit shrinks by $122 billion. Republicans again condemn Obama’s fiscal irresponsibility.

The economy may have begun to recover on its own, which is what usually happens in the absence of an activist government. Then came the impact of Obama’s and Pelosi’s spending.

October 2010: S&P endorses the nation’s AAA rating with a stable outlook, saying the United States looks to be in solid fiscal shape for the foreseeable future.

An exaggeration.

November 2010: Republicans win a U.S. House majority, citing the need for fiscal responsibility.

December 2010: Congressional Republicans demand extension of Bush tax cuts, relying entirely on deficit financing. GOP continues to accuse Obama of fiscal irresponsibility.

The left does not understand that government does not create wealth. Raising taxes in a recession is what Hoover did. I wouldn’t think they would want to copy him but they learn nothing.

March 2011: Congressional Republicans declare intention to hold full faith and credit of the United States hostage — a move without precedent in American history — until massive debt-reduction plan is approved.

July 2011: Obama offers Republicans a $4 trillion debt-reduction deal. GOP refuses, pushes debt-ceiling standoff until the last possible day, rattling international markets.

This is another lie. Obama and Boehner were close to an agreement and then Obama insisted on tax increases after agreeing not to do so. He responded to complaints from the left which is fixated on tax increases.

August 2011: S&P downgrades U.S. debt, citing GOP refusal to consider new revenues. Republicans rejoice and blame Obama for fiscal irresponsibility.

Another lie. The S&P report said the debt levels are too high and the agreement did not do enough to cut spending.

The outlook on the long-term rating is negative. We could lower the long-term rating to ‘AA’ within the next two years if we see that less reduction in spending than agreed to, higher interest rates, or new fiscal pressures during the period result in a higher general government debt trajectory than we currently assume in our base case.

There have been several instances since the mid 1990s in which I genuinely believed Republican politics couldn’t possibly get more blisteringly ridiculous. I was wrong; they just keep getting worse.

Steve Benen is a contributing writer to the Washington Monthly, joining the publication in August, 2008 as chief blogger for the Washington Monthly blog, Political Animal.

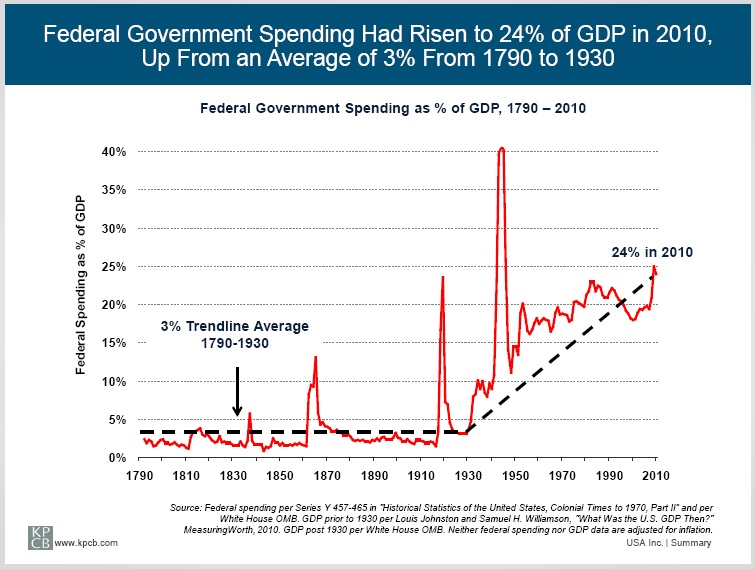

There was a time when Democrats understood economics. Those days are over. They have convinced themselves that money grows on trees. They are destroying this nation’s finances, with help from many Republican professional politicians. The only hope is the tea party and turning Obama out in 2013.

The following essay expresses my feelings better than I can.

(more…)