UPDATE: Megan McArdle has some doubts about house prices.

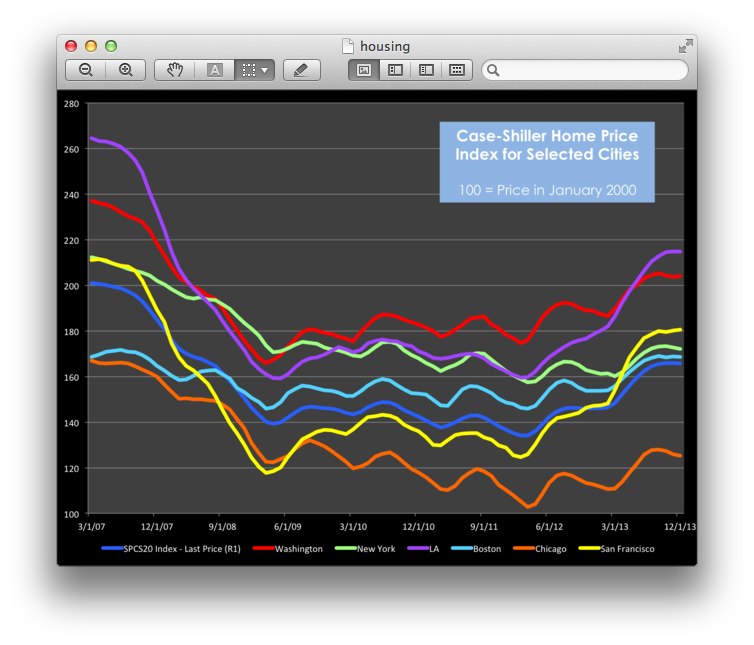

The housing inflation seems to be limited to certain cities. How will this last in the poor (except District of Columbia) economy ?

I live in south Orange County and have noticed a huge amount of rental construction going on. This area has been mostly single family homes and condos since 1972 when I moved here. Now, we see big projects like this and others nearby that I don’t know the name of. These are big projects including hundreds and perhaps thousands of units. The builder is the Irvine Company which, in my previous experience, has built mostly homes and condos. Recently, I began to notice more rental projects in Irvine.

The Irvine Company Apartment Communities is dedicated to making it easy to find a home you’ll love with unsurpassed services meeting your every need. With approximately 122 exceptional apartment communities located throughout the prime California regions of Orange County, West Los Angeles, San Diego and Silicon Valley, we offer choices to fit every lifestyle and budget.

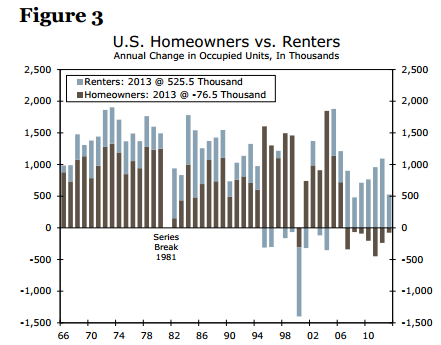

They seem to be going to rental property in a big way. Maybe this is the reason.

From reading the mainstream press all you hear are glorious signs of housing resurrection! Come one come all into the house of real estate where the almighty Fed will allow no harm to occur. Just sign and pray and the next thing you know you’ll be the next Donald Trump. The flipping, rehabbing, and housing shows are once again filling the space on a cable station near you. The perception of the Fed being this almighty protector of housing makes a bit of sense but where was the Fed in 2007?

I see lots of housing flips in southern California, not in Orange County so far.

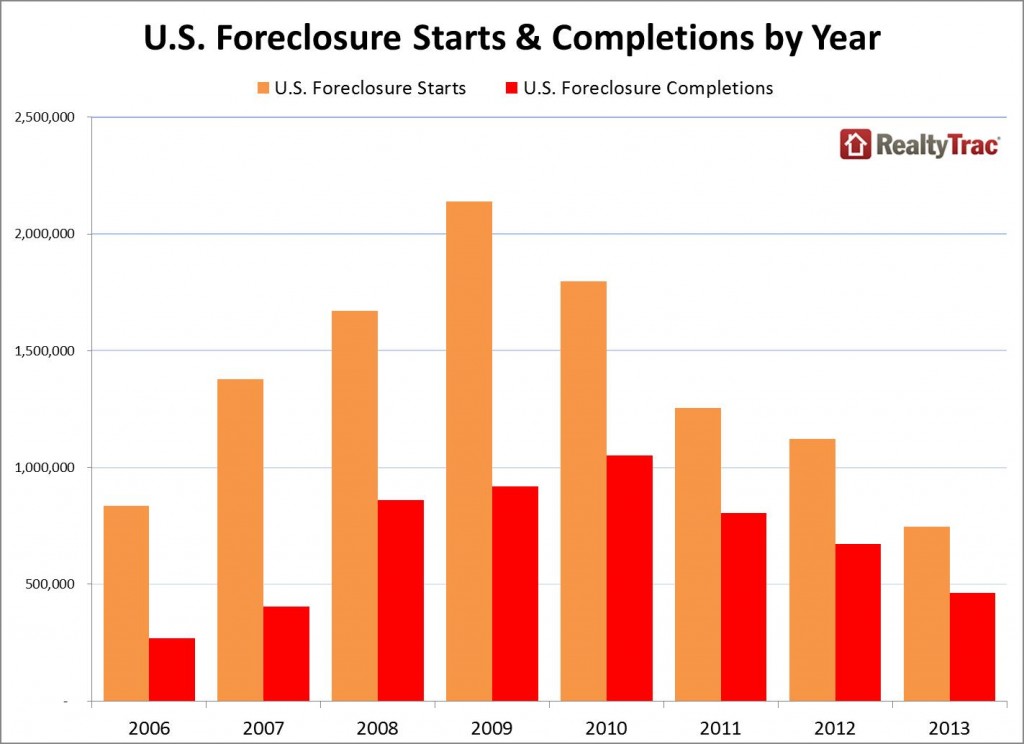

Even in 2013 we had 1.4 million properties with notice of defaults, scheduled auctions, and full on REOs taken on. Early in the crisis these stories were common since they were a novelty to the press. Now however, many of these properties are shifting over to large investors pushing inventory up. A clear consequence of this is a large pool of potential buyers that are unable to buy.

These may be the renters.

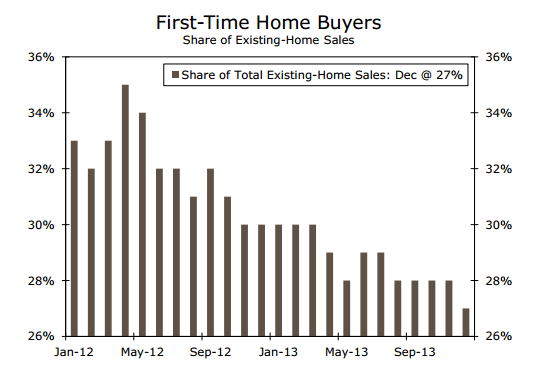

Yup. The would-be first time buyers have student loans and bad credit. They are renting.

The number of first time buyers is pathetic because household formation is weak and many young Americans are living at home with mom and dad. Forget about buying, they are having a tough time paying higher rents to the new feudal landlords. You would expect with the rapid rise in prices that existing home sales are off the charts but they are not.

Housing prices do NOT mean buyers who will be occupants. Look at mortgage applications !

Wow ! We are back to levels last seen nearly 20 years ago! Only difference is that we have 50,000,000 more people today walking the streets of the U.S. of A. than we did back then. Since access to middle class living is getting tougher thanks to weak income growth, more people are opting to rent:

This is what I am seeing in Orange County. I have been looking in San Pedro for a small house near the ocean. I can no longer afford Orange County except condos. I sold my house four years ago and bought a house in the mountains. That was a bad move. I found that I could not tolerate the altitude. I had to sell into the bad market of 2012. That cost me a lot. Now, I have to lower my sights and may just stay a renter for a while. At my age, it may make better sense.