UPDATE #2: Congress has a solution. Put ACORN in charge of lending standards. That will fix it.

UPDATE: More on he effect of the Stimulus Bill, or lack of it.

The economy still feels like it is very weak in spite of some talk about the recession being over. Here is an interesting analysis of the unemployment picture.

U.S. employment continues to decline, albeit much more slowly than at the beginning of 2009.

Declining more slowly is not the same as increasing. The President’s team wanted to trumpet good news as early as possible and they jumped the gun. A few weeks ago they had to adjust their message (again) to a less optimistic one. This was a communications mistake, not a policy one.

Employment growth will return. We just don’t know when, and the when is critical economically and politically.

Most forecasters expect a strong Q3 GDP number, to be released Thursday, October 29th. The two big questions are: (1) will that GDP growth be sustained through 2010, and (2) will it translate into job growth? The fiscal stimulus is temporary, and needs to translate into job growth and consumption growth to be sustainable.

The GDP growth is artificially inflated by massive outflows of money from the Fed and the “Stimulus” bill of last February. A similar effect might be obtained, with less corruption and misallocation, by pushing bales of money out of helicopters over the cities.

It is normal for employment not to grow at the beginning of a recovery. As demand for their products begins to increase, employers typically make their employees work longer hours before hiring new workers. Once the increased demand looks stable and predictable, and once the current workforce is working as much as they can, then employers start hiring. First you increase hours per worker, then you increase the number of workers.

There is a fallacy here, although not by the author of the blog post. Small business creates a very large proportion of the jobs in this country. The huge industrial corporations of the 1950s are mostly gone. Small business knows well that the Obama Administration is the enemy of small business. I don’t see small business expanding while he is president.

I recommend watching two numbers:

1. the unemployment rate – It was 9.8% in September. Most economists consider about 5% to be “full employment.” When will it begin to decline, and how long will it take to regain full employment?

2. the net change in payroll employment – This was –263,000 in September. First this needs to turn positive. Second, since the labor force grows with population, this number needs to reach +100K to +150K per month to keep up with population growth and keep the unemployment rate constant. Finally, it needs to exceed this range for the unemployment rate to decline toward 5%.

The press is paying a lot of attention to a third statistic, the U-6 measure of unemployment + underemployment. It’s an interesting and politically significant statistic, because it’s so much bigger than the traditional unemployment rate metric. But so far I don’t think it tells us a lot more about the trends than the above two metrics.

I will begin to feel good about the employment picture when we have had two consecutive months of payroll numbers >100K. At the same time you would expect the unemployment rate to start declining. I think the most important question you can ask an economic forecaster right now is, “When do you think the unemployment rate will begin to decline?”

I don’t see anything positive until this administration is gone, or at least until Nancy Pelosi is no longer Speaker.

I generally treat economic forecasts more than 12 months out as wild guesses. This year I have shortened that window to 6 months. I don’t think anyone has a clue what the employment picture will look like 9 or 12 months from now.

This uncertainty makes it hard for businesses to plan.

I’ll say ! The health care bill is another giant anchor around the neck of the economy.

Consumer spending is about 70% of GDP, and the most important determinants of consumption are (1) how many people are working and (2) are their paychecks going up?

Some on the right argue the fiscal stimulus is not helping increase economic growth. That’s silly. The government is pushing hundreds of billions of dollars out the door. At least in the short run, that’s going to increase GDP growth. We should see some of that effect in the Q3 GDP numbers nine days from now. The fiscal stimulus should continue to help increase GDP growth above what it otherwise would have been into and through most of 2010, especially in the first half.

I believe the stimulus is helping boost GDP growth now above what it otherwise would have been, but that it is too late, poorly designed, and horribly inefficient and wasteful. They are getting some bang, but their bang-for-the-buck and effectiveness are terrible.

I can do no better than to quote one of his commenters:

In an otherwise astute posting, you have one great silliness. It is silly to think the government can take a dollar out of the economy by borrowing, put the dollar back into the economy by spending, and conclude there’s a new dollar in the economy. Even in new math, plus one, subtract one, leaves a big zero.

I can’t improve on that. They are borrowing all the money they are spending.

Another great comment:

The recklessness, waste and fraud of the stimulus process (along with the various and sundry examples of gross incompetence and the effort to ram health care and climate disasters down our throats) has badly frightened small businesses around the country. When assessing the impact of the stimulus bill (or rather Obama’s fiscal policy — passed and proposed), an accurate accounting should also factor in the devastation caused by the fear produced thereby. FDR’s demonization of business in the 1936 campaign resulted in negative net investment and caused the Depression to relapse. Just as FDR’s rhetoric had investors heading for the hills, Obama’s policy efforts are causing prudent entrepreneurs to hunker down for the coming storm.

Obama has caused millions of people to anticipate massive problems in the future. These expectations are the biggest issue in the economy today.

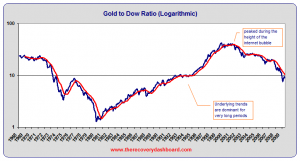

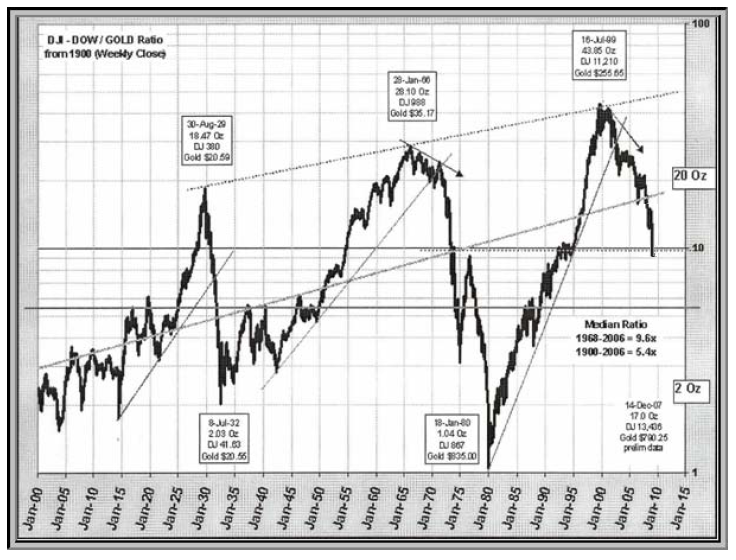

Take a look at this chart. It is the Dow Industrials adjusted for gold price.

During the latest period since 1980 the Gold to Dow ratio saw an incredibly consistent trend upward to a peak of 44 in July of 1999 and has since experienced a consistent downward leg to the current ratio of about 9 ounces of gold to the Dow.

Given the historical trends, it is likely the Gold to Dow ratio will again hit the 1-2 range within the next few years.

This is the real story. I just hope we don’t end up like Argentina. The chart is hard to read but the bottom was 1980. Here is another, easier, chart.

These charts are from the Sagflation Blog. Look at 1980.

Anyone who has not read Amity Schlaes’ book, The Forgotten Man, will be excused to go read it and come back.

After reading your post, I saw this in one of my newsletters and thought you’d get something out of it in regard to that reference to 5% unemployment…

“The U.S. has shed 7.2 million jobs,” reads today’s WSJ, “since the recession began in December 2007, the deepest contraction since the Great Depression. Even if the job market started spitting out jobs as fast as it did during the 1990s boom, adding 2.15 million private-sector jobs a year, the U.S. wouldn’t get back to a 5% unemployment rate until late 2017.”

Yeah, it is really going to get ugly if the stock market turns down again. Have you seen the market adjusted for inflation ? I’ll try to find the chart and post it.

Mike,

A few points:

1) The REAL unemployment stat to watch is U6. (As is pointed out by Keith.) (Anyone who isn’t familiar with BLS classifications can simply google “U6”.

2) Exactly what “jobs” are to be created even when (if) the economy does turn around? What is “small business?” If we’re talking merchants selling goods made overseas then that’s not what I call recovery. If you’re talking service… what sorts of service? Is it a sign of a healthy economy to grow… say… the legal profession? (Rhetorical question – the answer is “no.”)

3) Are you aware of any broad movement acting to improve K-12 and college undergraduate education so that our children and young adults are gaining actual skills commensurate with the costs associated? I’m sure not!

4) Is there ANY reason to believe the dollar won’t CONTINUE to decline? (Not that I’m aware of.)

5) Is there ANY reason to believe we’re not looking towards growing stagflation – perhaps even subjective hyperinflation – as the coming reality of 2010, 2011, and perhaps beyond…???

BILL

Hiya Mike,

A few points:

1) The REAL unemployment stat to watch is U6. (As is pointed out by Keith.) (Anyone who isn’t familiar with BLS classifications can simply google “U6”.

2) Exactly what “jobs” are to be created even when (if) the economy does turn around? What is “small business?” If we’re talking merchants selling goods made overseas then that’s not what I call recovery. If you’re talking service… what sorts of service? Is it a sign of a healthy economy to grow… say… the legal profession? (Rhetorical question – the answer is “no.”)

3) Are you aware of any broad movement acting to improve K-12 and college undergraduate education so that our children and young adults are gaining actual skills commensurate with the costs associated? I’m sure not!

4) Is there ANY reason to believe the dollar won’t CONTINUE to decline? (Not that I’m aware of.)

5) Is there ANY reason to believe we’re not looking towards growing stagflation – perhaps even subjective hyperinflation – as the coming reality of 2010, 2011, and perhaps beyond…???

BILL

THis from Bill who couldn’t get it posted.

A few points:

1) The REAL unemployment stat to watch is U6. (As is pointed out by Keith.)

(Anyone who isn’t familiar with BLS classifications can simply google “U6”.

2) Exactly what “jobs” are to be created even when (if) the economy does

turn around? What is “small business?” If we’re talking merchants selling

goods made overseas then that’s not what I call recovery. If you’re talking

service… what sorts of service? Is it a sign of a healthy economy to

grow… say… the legal profession? (Rhetorical question – the answer is

“no.”)

3) Are you aware of any broad movement acting to improve K-12 and college

undergraduate education so that our children and young adults are gaining

actual skills commensurate with the costs associated? I’m sure not!

4) Is there ANY reason to believe the dollar won’t CONTINUE to decline? (Not

that I’m aware of.)

5) Is there ANY reason to believe we’re not looking towards growing

stagflation – perhaps even subjective hyperinflation – as the coming

reality of 2010, 2011, and perhaps beyond…???

BILL

Thanks, Mike!

BILL

Valuable thoughts and advices. I read your topic with great interest.